The Current Situation

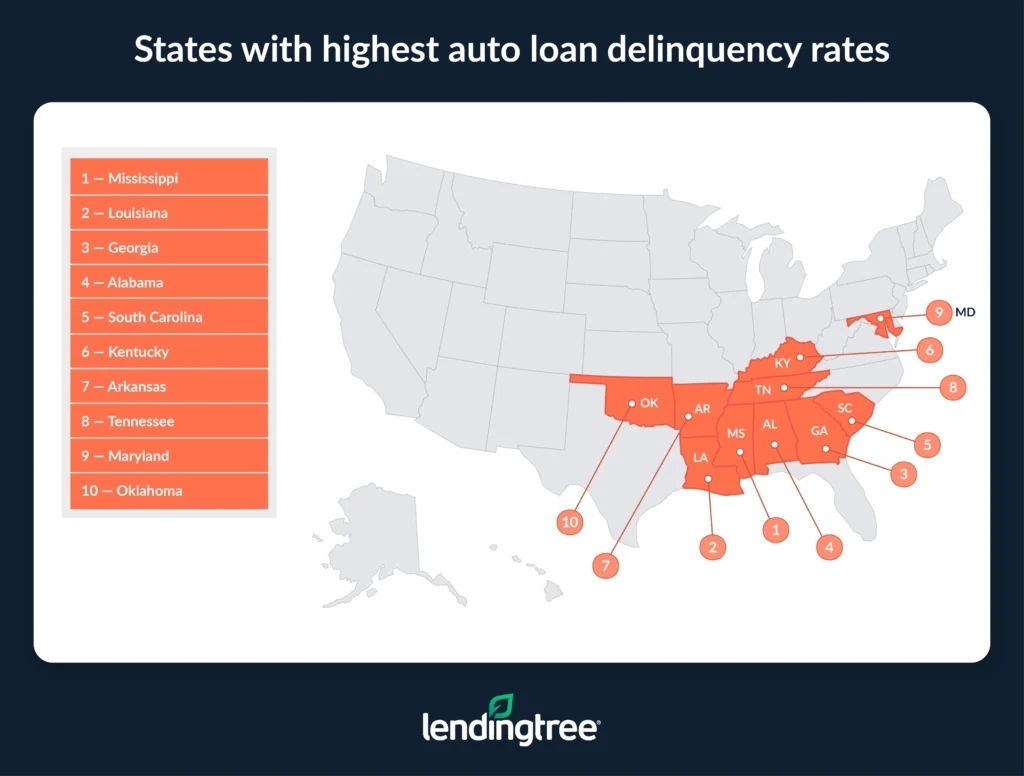

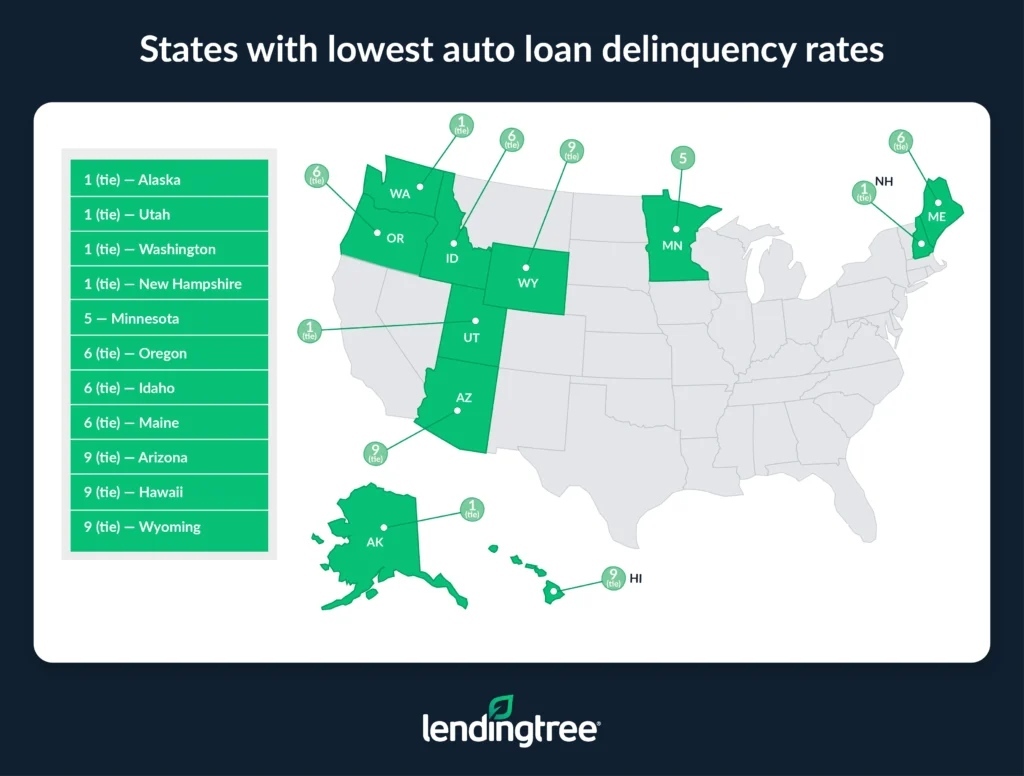

It seems the auto industry is navigating some rough waters these days. A recent study highlights that 5.1% of Americans are struggling to keep up with their car payments. This statistic is a snapshot of the broader economic challenges that folks are facing—slow hiring trends, impacts from tariffs, and an uptick in the Consumer Price Index. But not all states are affected the same way, with Southern states like Mississippi, Louisiana, and Georgia seeing higher rates of delinquencies.

Delinquency Stats

Looking at some numbers gives a clearer picture. In Mississippi, 9.8% of car owners are behind on payments, and it’s not much better in Louisiana and Georgia. Typically, these states grapple with higher monthly payment burdens, where the national average is $751, but Mississippi’s residents are staring at $802, with Louisiana not far behind at $821. It’s about more than just money in hand; it’s about paycheck pressure in some of America’s lower-income regions.

Trouble Indicators

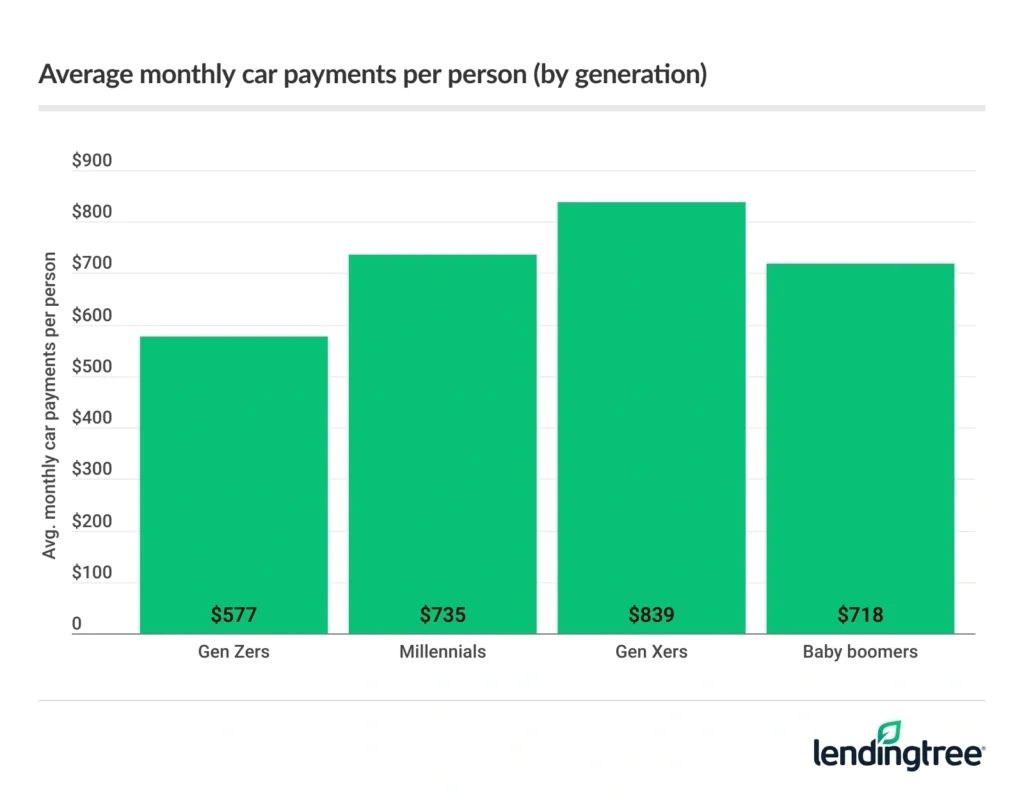

LendingTree’s report also gives some context by age. Gen Z and Millennials are leading with the highest delinquency rates. Despite having the smallest average payments—Gen Z at $577—these groups still find it tough to manage. The story changes with Baby Boomers, who enjoy the lowest delinquency rate of just 1.9%. It’s clear age plays a role in financial stability, reflecting maybe more settled finances for those a bit older.

A Closer Look at Causes

Why are these delinquencies happening? Auto loans are crucial because they keep the wheels turning quite literally—enabling people to get to work and make a living. However, factors like persistent inflation and high interest rates only add to the financial squeeze, hitting those barely making it, especially in economically struggling states.

What Lies Ahead?

Looking forward, there’s some apprehension. About 2% of borrowers have been late by 30 days, with delinquencies worsening for those 60 to 120 days behind. What’s telling is how this reflects on the economic uncertainty—we’re not just talking financial numbers here, but the growing struggle for many to maintain their essential mobility. If interest rates don’t ease up soon, this trend might see more cars repossessed or worse, a potential need for state-level interventions.

The takeaway is simple but worrying: cars are more than luxury, they’re often a necessity. And with current economic forecasts pointing towards continued pressure, there might be more stories of hardworking folks falling behind on their car payments.

Maserati's Rocky Road

Tesla Rolls Out Robotaxis

GTI Edition 50 Unleashed

Retro Racing Reborn

Corvette ZR1X Unleashed