Overview

Ever since the COVID-19 pandemic hit, luxury markets including classic cars witnessed skyrocketing prices. Folks were trapped indoors with nothing but time and a bit of savings, itching to invest in something special. Fast forward a few years, and the market appears to have cooled down, with prices retreating to what they were before this rollercoaster began.

Market Shift

During the pandemic, people found themselves with disposable income and nowhere to spend it. Thanks to online sales, demand for luxury goods and classic cars surged. Buyers were paying top dollar for rare finds like Rolex watches and classic Ferraris.

One prime example is the 1959 Ferrari 250 GT LWB California Spider Competizione. This beauty, one of just eight with an aluminum body, was sold for $4.95 million back in 2007 and then flipped for $17.99 million in 2017 after a lavish restoration. But at a recent sale in Amelia, it was auctioned for “just” $9.47 million. That’s a 47 percent drop from its previous sale, signaling a significant price correction in the market.

Why the Drop?

Market Trends

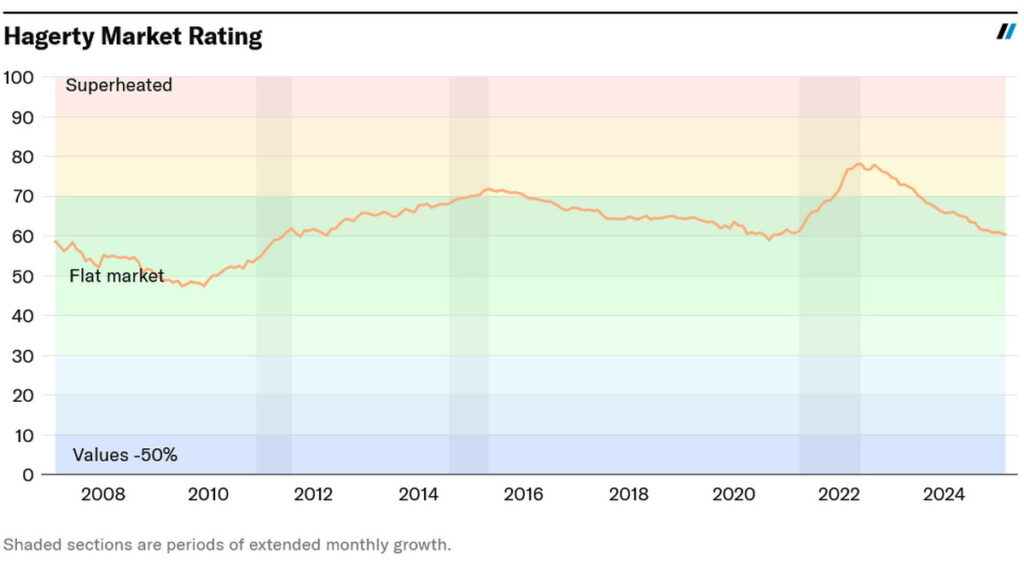

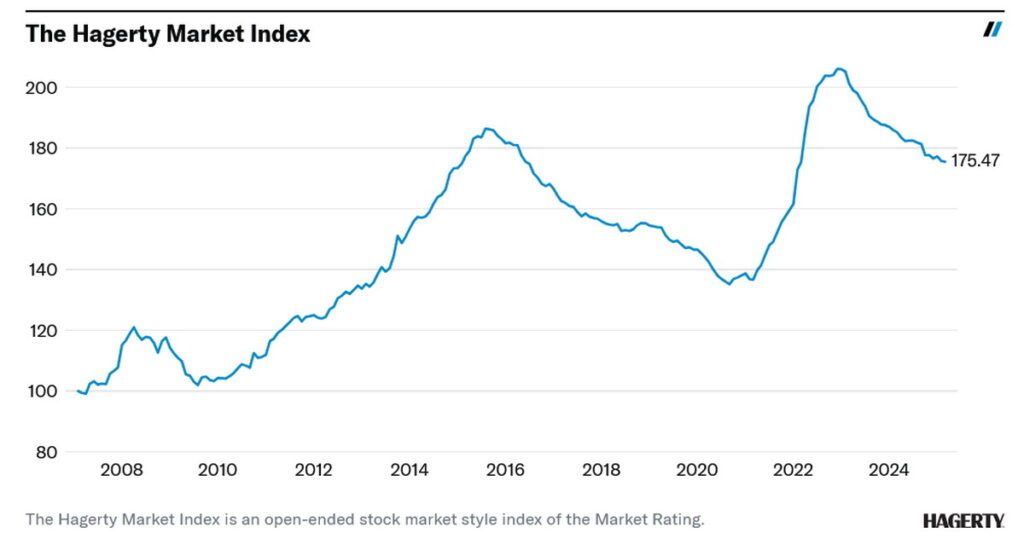

The car market isn’t unique in this downturn. According to Hagerty’s Market Rating of 60.39, which is the lowest since November 2020, the entire classic car market has reset to pre-pandemic levels. This trend suggests a broader economic uncertainty and less willingness to pay these inflated prices. Hagerty also confirms that the percentage of cars being sold above their insured value has plummeted to 38.9 percent. Clearly, buyers are more cautious now than ever before.

Economic Climate

The economic landscape is rocky, with geopolitical tensions and global economic uncertainties at play. As the market isn’t currently conducive to inflated prices, potential buyers are tentative about jumping into high-value purchases. This sentiment has been amplified by U.S. policies making international deals more challenging, further impacting the global market dynamics.

Driving Experience

For those lucky enough to experience the original Ferrari 250 GT, it’s a mix of nostalgia and raw driving prowess. The car handles with a grace and style that today’s digital-age vehicles often lack. It’s more mechanical, more visceral. Driving a 250 GT isn’t just about speed—it’s about connecting with decades of automotive excellence. However, given today’s prices and the investment potential, one could argue that the driving experience alone might not justify the cost, especially when models like the Porsche 911 or the Jaguar E-Type offer thrilling experiences for much less.

Conclusion

While the market’s correction may seem like a downturn, it could also represent a return to stability and realistic pricing. For collectors and enthusiasts, this might be the perfect time to snag a dream car without emptying the bank account. But, as always, the key is doing the research and ensuring any investment matches personal passions and market trends.

Charger Crash Drama

Electric Pickup Mystery

Audi RS6 Avant GT

Auto Tariffs Remain

Subaru Show Scare