The Tariff Impact

With President Trump’s recent move to impose a 25% tariff on imported vehicles aimed at bolstering American manufacturing, things aren’t as straightforward as they sound. While it’s an effort to safeguard U.S. automakers and jobs, the reality is a bit more complex and could potentially ricochet back onto domestic brands like a boomerang.

Who Sells What

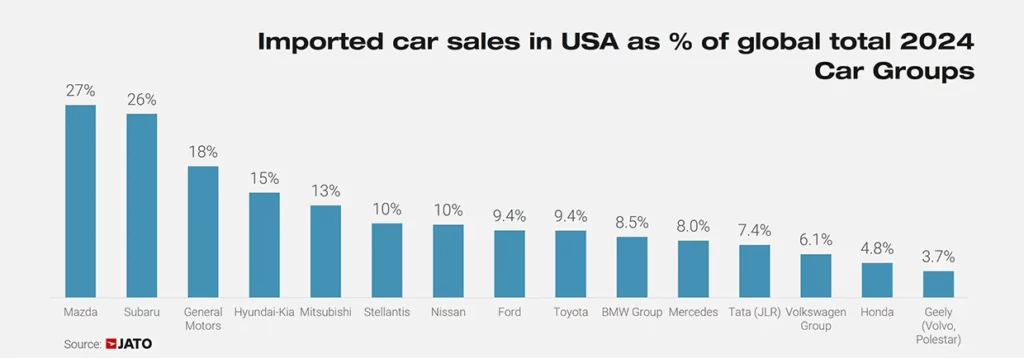

Domestic giants such as GM, Ford, and Stellantis, often referred to as Detroit’s Big Three, sold a whopping 1.85 million imported light vehicles in the United States in the last year. This figure accounts for 13% of their global sales, proving that these companies rely significantly on their foreign plants situated in countries like Canada and Mexico.

Japanese Rivals

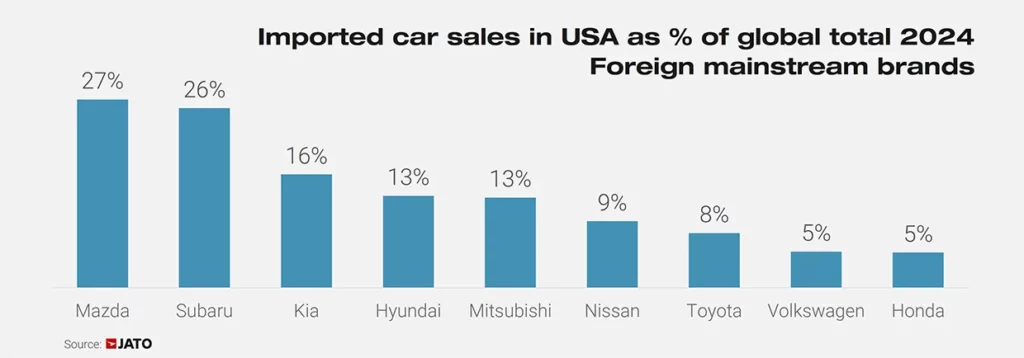

In the same period, the major Japanese players—Toyota, Honda, and Nissan—collectively sold 1.53 million vehicles in the U.S., making up only 9% of their global sales. This indicates a more balanced global operation compared to their American counterparts.

European Players

On the European front, automakers like Volkswagen, BMW, and Mercedes-Benz also have a smaller reliance on the U.S. market with imports making up 7% of their total sales. Clearly, the international spread of sales is more diversified for these brands.

The Economic Ripple

For General Motors, the story unfolds with a more pronounced impact. GM ranks near the top of vehicle imports into the U.S., with 18% of its cars being imported, the highest rate among the world’s top five automakers. As Chinese consumers lean towards homegrown brands, GM’s reliance on the U.S. market becomes even more pressing.

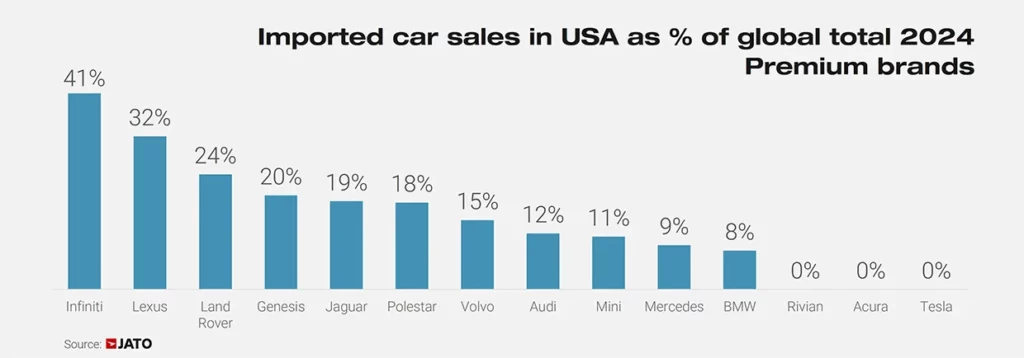

Analysts at JATO Dynamics emphasize the challenges arising from the increased product costs in the U.S., which is now becoming trickier to manage for non-Chinese automakers. This trend might push automakers to bring more production stateside.

Moving Production Stateside

Even Subaru faces a predicament, with the U.S. market comprising 71% of its total sales last year. Automakers including Volkswagen, Volvo, Hyundai-Kia, Mercedes, Toyota, and Nissan are likely to expand their manufacturing footprint in the U.S. rather than risk losing a key segment of their customer base.

While Trump’s strategy may seem rugged and blunt, it could inadvertently steer automakers to rethink their production strategies and align more closely with American interests, leading to a potential surge in local automotive jobs. However, this shift will require time and adaptation, and during this transition, U.S. brands may feel the pinch just as sharply as their foreign rivals.

AMG Wagon Comeback

Cadillac XT6 Bows Out

Porsche's Sales Shift

Kia's Electric Truck

Vanished Range Booster