Big Financial Oversight

The United Auto Workers (UAW) found themselves in a challenging situation back in 2023 after deciding to liquidate $340 million of stock investments to support widespread strikes. The union, known for its complex financial management, discovered that this decision came with an unexpectedly hefty price tag. An oversight has allegedly cost them around $80 million in unrealized investment gains. That’s a sizable amount even for an organization as substantial as the UAW.

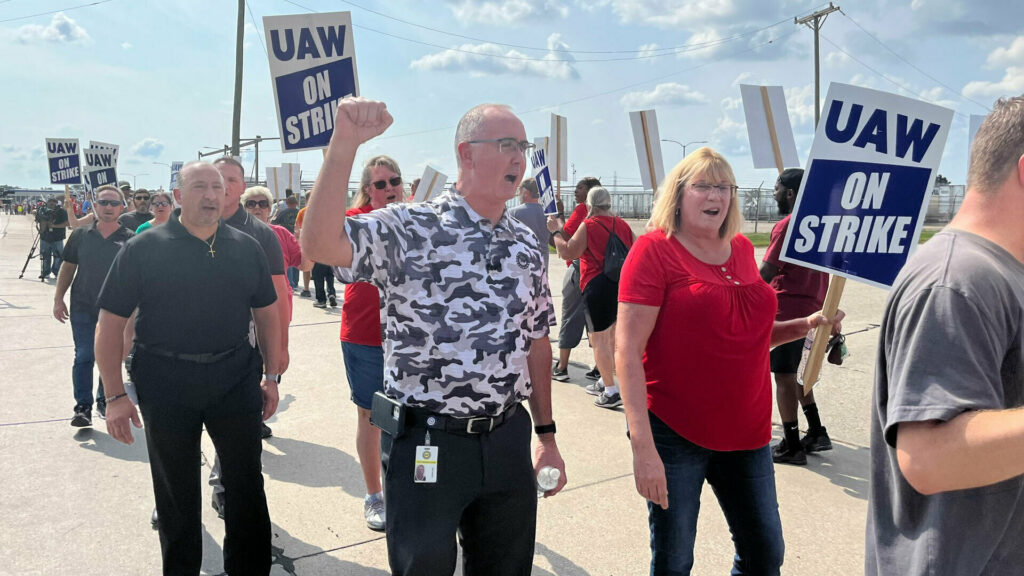

Strikes and Costs

When the UAW decided to support its members through a weeks-long strike, they had to ensure workers maintained a living stipend of $500 a week. This came out of the aforementioned fund liquidated from stock investments. The intent was good, as the represented workers needed some financial stability during the strike.

Investment Policies

The union has stipulated policies dictating that 30% of funds must be invested in stocks and 53% in fixed income. However, after these strikes ended and new agreements were put in place, the money wasn’t reinvested into stocks in line with the UAW’s investment protocols. This deviation from their usual financial strategy led to substantial potential losses.

Significant Funds Not Reinvested

Despite having clear guidelines, nearly none of the liquidated funds found their way back into the stock market, which could have potentially tracked indices like the Russell 3000. The oversight was revealed through a comparison of what could have been gained if typical investment allocations had been followed.

Current Portfolio Management

Currently, the UAW holds about 30% of its assets in stocks, 53% in fixed income, and another 17% in alternative investments. This mix aims to balance risk and returns, but the actual financial maneuvers have not always aligned with this strategy, leading to questions from within the union about their financial acumen and oversight.

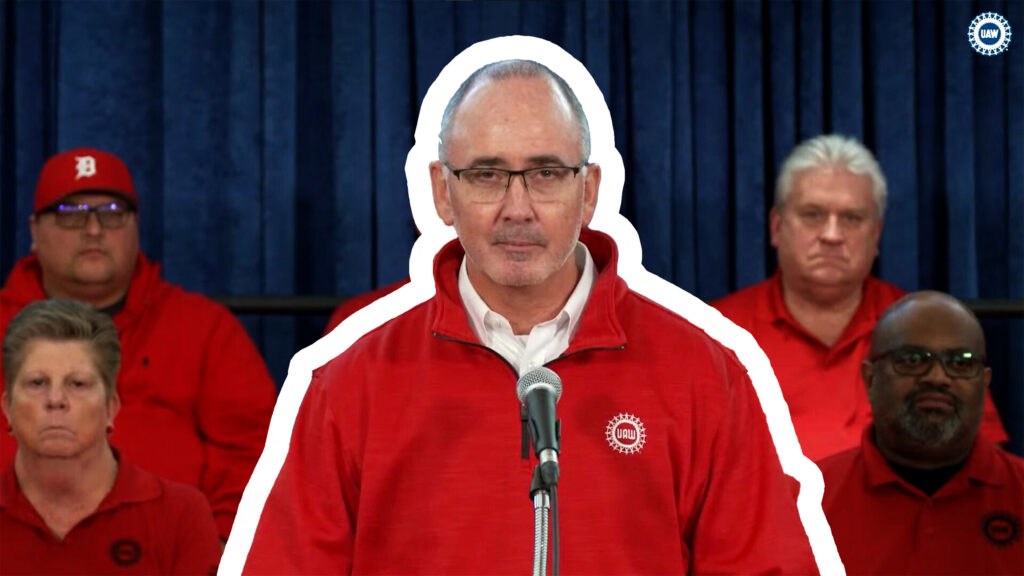

Leadership and Accountability

Shawn Fain, the UAW president, has been demanding answers about the lower-than-expected returns. A federal monitor, appointed as a result of a previous settlement with the US Department of Justice following a corruption scandal, is now reviewing the case. The responsibility for these investment outcomes lies with both the union’s president and several vice presidents, including the secretary-treasurer.

What’s Next?

This incident underlines the importance of adhering to strategic investment policies. For unions like the UAW, navigating financial decisions during turbulent times requires not only sound judgment but also transparency and accountability to prevent any financial missteps that could impact their long-term sustainability.

Bentley Custom Style

Electric M3 Unveiled

Lexus LFR Unveiled

Audi Q3: Compact Versatility

Lexus LFR Unveiled