Hertz’s Rebound

Boy, Hertz has been on quite the ride these past few years. Back in 2020 when COVID hit us all hard, Hertz couldn’t keep up with its lease payments and ended up filing for Chapter 11 bankruptcy. But, like a classic comeback story, they didn’t stay down for long. After bouncing back, the rental giant went big on electric, ordering over 100,000 EVs from Tesla and others. Fast forward a bit, and now there’s a new major player on the scene—Bill Ackman’s Pershing Square. This move has sent Hertz’s stocks soaring like nobody’s business.

Sizzling Stocks

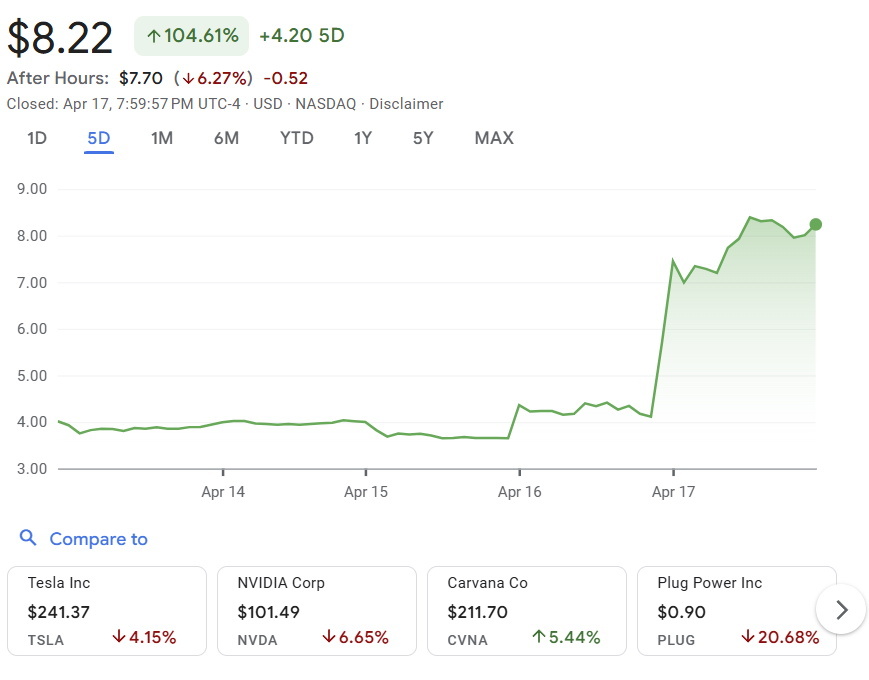

So, here’s the deal. Bill Ackman scooped up a hefty 12.7 million shares of Hertz, which is a 4.1% slice of the company pie, and when the news hit the wires, it was like lighting a firework. Hertz stock skyrocketed over 120% ending the day at $8.22 per share! Now that’s some serious market action.

Ackman’s Strategy

Ackman didn’t just dabble; he went all in. He snagged these shares through 2024, bringing his total Hertz interests to a whopping 19.8% when you count shares and swaps. This kind of weight in a company is why folks are buzzing. They’re hopeful because Ackman’s got a track record for turning things around.

Financial Woes

Despite all the buzz, Hertz isn’t out of the woods just yet. In 2024, Hertz reported a staggering $2.9 billion loss. They had to cut down their EV fleet, which accounted for a $245 million chunk of that loss. But hey, every cloud has a silver lining. Hertz dropping EVs at discounts meant a sweet deal for anyone looking to snag an electric ride for less.

Buying Opportunities

Hertz was in such a hurry to sell some of these EVs that they were emailing renters, offering them the chance to buy cars right off the lot. Picture this: a 2023 Tesla Model 3 for just $17,913! For anyone in the market for a bargain, this was like hitting the jackpot.

Looking Ahead

Ackman’s not just seeing the numbers, he’s seeing potential. The man is betting that with some industry shifts and rational competition, plus a revamped leadership team, Hertz can make a powerful comeback. He’s banking on this new direction to steer them out of the red and maybe, just maybe, hit $30 a share by 2029.

So while Hertz has had a crazy few years—from the brink of collapse to being the belle of the ball in the stock market—there’s a lot riding on Ackman’s vision. With luck and strategy, this rental kingpin might very well be on the brink of another incredible transformation.

Corvette EV Future

VW Keeps Prices Stable

Hyundai's 2025 Vision

Timeless V8 Classic

Kia's Milan Impact