Car Tariffs

The introduction of a 25% tariff on imported cars and parts by former U.S. President Donald Trump has stirred quite a debate nationwide. The tariff, effective from April 2 for vehicles and expected to cover car parts starting May 3, aims to boost domestic production, but not everyone is convinced of its benefits. Detroit’s Big Three – General Motors, Ford, and Stellantis – anticipate significant financial impacts. They’re looking at ascending expenses and potential profit hits, while the United Auto Workers’ (UAW) president, Shawn Fain, stands firmly in support of the measure.

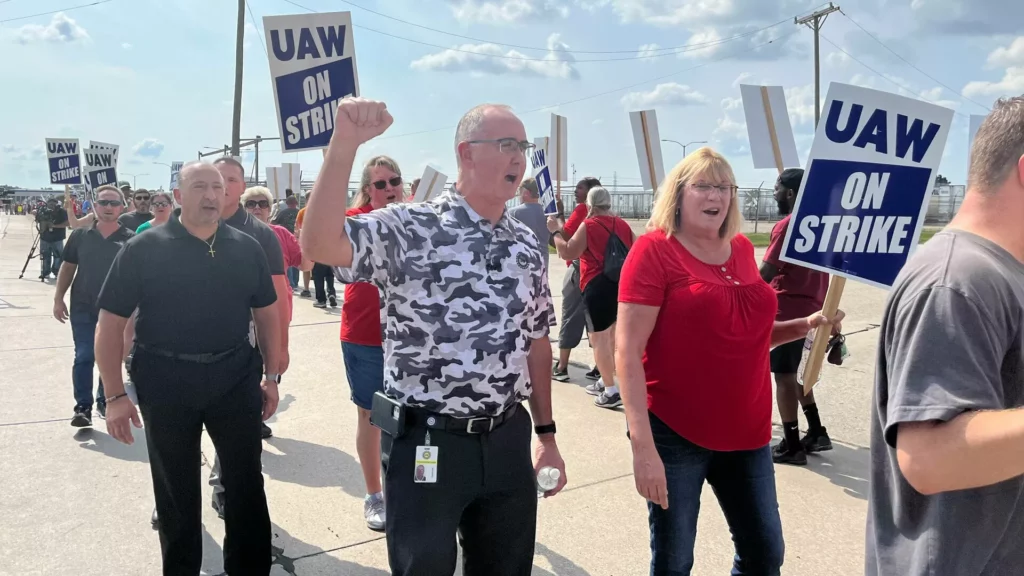

UAW’s Stance

Shawn Fain, UAW’s president, is a vocal supporter of the tariff. His argument hinges on its potential to invigorate U.S. production and secure high-paying jobs in the automotive sector. Fain frames the tariff as a countermeasure to the “harms” of free trade, which he believes has led American companies to outsource jobs to areas with lower labor costs, like Mexico and Canada. During an address to UAW members, Fain articulated his stance, describing free trade as one of the most harmful policies to American labor in recent times.

Carmakers’ Reactions

Auto manufacturers, though not thrilled with the tariff, are shaping their strategies to mitigate its effects. While Stellantis decided to temporarily suspend operations at some plants, General Motors opted for a different approach by ramping up production of popular models like the Chevrolet Silverado and GMC Sierra. Each of these moves reflects their varied strategies to cope with potential disruptions in their supply chains and production schedules.

Economic Implications

A lot of pundits believe the tariff may lead to higher car prices, with American consumers likely bearing the brunt. The Center for Automotive Research estimates the domestic auto industry could incur costs as steep as $107.9 billion, affecting an annual production of about 6.8 million vehicles. Prices for cars could climb by $2,500 to as much as $20,000 depending on the type of vehicle, making new cars less accessible for many buyers and pushing them towards the used car market. This shift could inadvertently raise the prices of used cars as well due to increased demand.

Local Impact Concerns

Some state leaders, like Michigan Governor Gretchen Whitmer, caution against the tariff’s longer-term ramifications on local businesses and jobs. Suppliers already strained by the COVID-19 pandemic and inflation may struggle under the added pressure of tariff-induced cost increases. There is concern that this shake-up might lead to job losses within the UAW ranks, affecting the livelihoods of many workers.

Looking Ahead

The debate over Trump’s tariff is still very much alive. Supporters champion it as an opportunity to tighten borders on trade and foster domestic economic growth. Critics, however, argue that it might destabilize the automotive sector, impose new burdens on consumers, and hurt operations of American car manufacturers. The full impact remains to be seen, but as it stands, both sides present compelling arguments. The question remains: will this tariff ultimately bolster the U.S. economy, or will it prove to be an obstacle to recovery and growth in the auto industry?

Electric Truck Revolution

Porsche 911 Bargain

GM Van Production Halt

Electric Leader Emerges

Van Era Ending